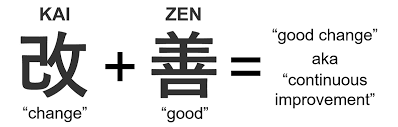

In the world of managing oneself, people, and processes, one of the most effective methodologies for achieving continuous improvement is the Kaizen method. Originating in Japan, Kaizen means “change for better,” and it emphasizes the incremental and continuous improvement of processes. This approach has proven to be highly beneficial in various industries, including loan servicing. In this blog, we will explore how loan servicers and anyone seeking to enhance their performance can employ Kaizen for post-mortem analysis and develop a personalized approach for sustained growth.

The Kaizen Approach to Analysis

Identifying What Worked

Kaizen begins with recognizing and acknowledging the aspects of your process that have been successful. This involves conducting a comprehensive assessment of your projects or loan servicing operations. Start by examining the key performance indicators (KPIs) and project goals. What did you accomplish, and what contributed to those successes? Gather data, feedback, and insights from all relevant stakeholders to gain a well-rounded understanding of the strengths of your process.

Understanding What Didn’t Work

To improve and grow, it’s equally important to identify and analyze the areas that did not perform as expected. This includes recognizing bottlenecks, errors, inefficiencies, and any elements that hindered your success. Consider the root causes of these issues and explore why they occurred. Analyze the data and feedback collected during the project or loan servicing period to pinpoint the problem areas.

Short-Term Approaches for Improvement

With a clear understanding of what worked and what didn’t, you can now take action to address these areas in the short term. Start by creating an action plan that outlines specific steps to correct the issues and enhance your process. In the case of loan servicing, this might involve refining communication between customers and servicers, streamlining document handling, or increasing response times. The key to short-term improvement is to make manageable and immediate changes that can have a positive impact.

Long-Term Approaches for Continuous Growth

While short-term fixes are crucial, the Kaizen method emphasizes the importance of ongoing, incremental changes for long-term success. Consider the feedback and data gathered during the post-mortem analysis to create a long-term plan for improvement. This plan should address root causes and focus on structural changes that can prevent similar issues in the future. In the context of loan servicing, this might involve implementing new technology, revising training programs, or developing a more robust quality control system.

A Personalized Approach to Kaizen

Adopting the Kaizen method for analysis is not a one-size-fits-all solution. To make it effective, it’s crucial to personalize your approach. Here’s a step-by-step guide to crafting your Kaizen-inspired strategy:

- Set Clear Objectives: Define what you want to achieve with your post-mortem analysis and continuous improvement efforts. Having clear goals will guide your actions.

- Gather Data and Feedback: Collect quantitative and qualitative data from various sources, including employees, customers, and project stakeholders. This information will be the foundation of your analysis.

- Identify Root Causes: Dive deep into the data to understand why certain aspects of your process succeeded or failed. Addressing root causes is the key to lasting improvement.

- Prioritize Actions: Determine which issues require immediate attention and which can be part of a long-term strategy. Prioritization ensures that you focus on the most critical areas first.

- Implement Short-Term Fixes: Begin with quick, tangible changes to address immediate issues and demonstrate your commitment to improvement.

- Develop Long-Term Plans: Create a detailed, step-by-step plan for ongoing improvement, incorporating the lessons learned from the post-mortem analysis.

- Involve All Stakeholders: Engage employees, clients, and relevant stakeholders in the process. Encourage them to contribute their insights and ideas for improvement.

- Monitor and Adjust: Regularly evaluate your progress, gather feedback, and adjust your strategies as needed. Continuous monitoring ensures that you stay on track.

- Celebrate Achievements: Acknowledge and celebrate both short-term and long-term improvements to boost morale and maintain motivation.

The Kaizen method is a powerful tool for analysis and continuous improvement in loan servicing and various other fields. Although this can be done at any stage of a process or project, I find it especially useful at the end of a month or project. By identifying what worked, understanding what didn’t, and implementing short-term and long-term strategies, you can enhance your processes and achieve sustained growth. Remember that a personalized approach is key to making Kaizen work for your specific needs and objectives. Embrace this method, and you’ll be on the path to achieving “change for better” in your projects and loan servicing operations.